1119724-A AJL 932143 GST Reg. Thu Aug 18 2022 703 PM 1993 HAULMARK 7X24.

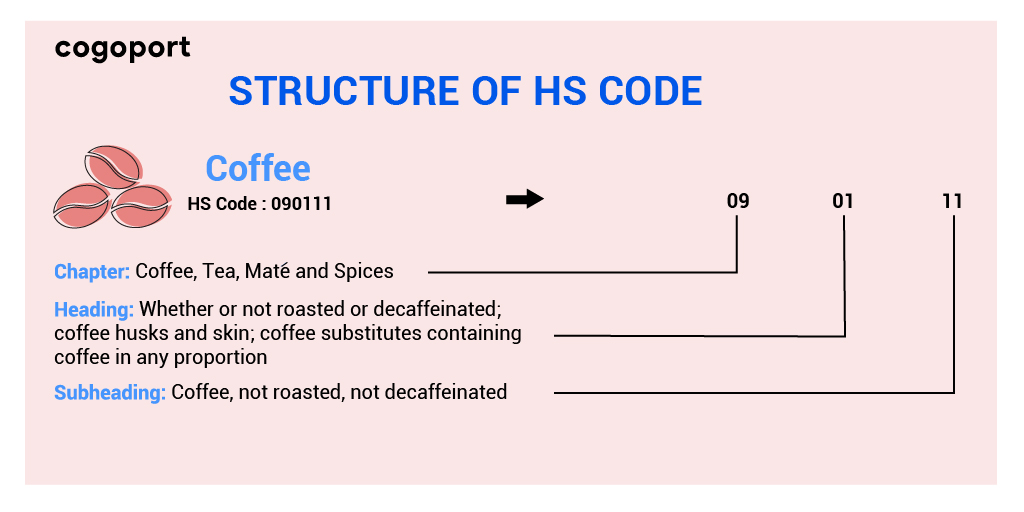

Hs Code All About Classification Of Goods In Export Import

There are 21 offenses under GST.

. Oaths and Declarations Ordinance Cap 11. Besides extending the scope of e-invoicing rules. Guidance Note on Tax Audit under Section 44AB.

The implementation of the Goods and Services Tax GST in India was a historical move as it marked a significant indirect tax reform. A 15-digit distinctive code that is provided to every taxpayer is the GSTIN. Ramlee 50250 Kuala Lumpur Malaysia.

Scan and get access to GST Portal via mobile. Roadtrain lead full width rear ramp load through side load new brakes bearings and tyres good condition 180000 plus gst 18. 29 May 2017 Trading Participant Circular No.

Statutory Declaration Act No. Site Access Information. Strategic Trade Act is an Act to provide for control over the export transshipment transit and brokering of strategic items including arms and related material and other activities that will or may facilitate the design development and production of weapons of mass destruction and their delivery systems and to provide for other matters connected therewith consistent with.

Offences Penalties Offences. Amendments to the Rules of Bursa Malaysia Derivatives Berhad Rules of Bursa Derivatives. The major offenses under GST are.

It will be sent together with Security Code via SMS to your registered mobile number. Malaysia is a southeast Asian nation. Name of the Act Late fees for every day of delay.

Royal Malaysian Customs Department. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. For some of the items it should be no duty.

Tax invoices sets out the information requirements for a tax invoice in more detail. Annexure 2 Amendments to DMA Handbook Effective. 1119724-A AJL 932143 GST Reg.

18th Floor Menara UMW Jalan Puncak off Jalan P. We have mentioned a few here. View All Online Auctions.

GSTR 20131 Goods and services tax. View GST Invoice of your travel. Clause 44 Clarifications As Per New Tax Audit Guidance Note AY 22-23.

Amendments to the Direct Market Access Handbook DMA Handbook issued vide TP Circular 232010. Top reasons to make a business investment in Malaysia. GST Registered Customers Applicable GST IGST or CGST and SGSTUGST shall be based on your GSTIN submitted for bookings and the embarking location for each leg of the itinerary.

18th Floor Menara UMW Jalan Puncak off Jalan P. Check With Expert GST shall be levied and charged on the taxable supply of goods and services. View All Popular Posts.

When we are talking about business among other business curriculums starting a Limited Liability partnership in Malaysia remains one of a kind business structure. John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. The history of the Goods and Services Tax in India dates back to the year 2000 and culminates in 2017 with four bills relating to it becoming an ActThe GST Act aims to streamline taxes for goods and services across India.

Business opportunities during Covid pandemic in Malaysia. For issuance of proper tax invoice by the airline please ensure that GSTIN in capital letters name of GSTIN Customer and e-mail address are correctly mentioned at. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596. To prevent tax evasion and corruption GST has brought in strict provisions for offenders regarding penalties prosecution and arrest.

The Central Board of Indirect Taxes and Customs CBIC is the nodal national agency responsible for administering Customs GST Central Excise Service Tax Narcotics in India. SST vs GST Differentiating tax policies in Malaysia. Place of Supply State Code.

John can claim a GST credit of 100 on his activity statement. Rs 25 Total late fees to be paid per day. HSN Code List for GST Download HSN SAC Code List in Excel PDF Format.

Starting January 1 2022 several key amendments in the goods and services tax GST regime will be implemented. 1 March 2017. Central Goods and Services Act 2017.

Analysis of Clause 44 of Tax Audit Report. For the entire list of 21 offenses please go to our main article on offenses. Enumerated list of states.

Sales Use Tax Resale Certification PDF. The country has immense natural resources huge cultural diversities and strong business opportunities. Ramlee 50250 Kuala Lumpur Malaysia.

GST - Know about Goods and Services Tax in India with various types and benefits. The state must be selected from the latest list given by GSTN. Some of the main uses of GSTIN are.

Check GST rates registration returns certification and latest news on GST. The place of supply state code to be selected here. Recipients State Code.

This is the second level protection to authenticate your transaction. We list key GST changes in India for 2022 which impact the scope of supplies and enforcement mechanisms withdraws concessions introduces input credit restrictions etc. HSN Code is Require when you register on GST Portal.

Further add other details like the purchase order number PO if any invoice date invoice number and invoice due date. Latest GST Ready Reckoner 2022 by CA Raman Singla Join GST Customs Excel. The Customs Central Excise department was established in the year 1855 by the then British Governor General of India to administer customs laws in India and.

Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021. Based on the location of the recipient rather than the purchaser so the purchaser must provide the recipients ZIP code at the time of the order. Taxable and non-taxable sales.

The place localitydistrictstate of the buyer on whom the invoice is raised billed to must be. As the name depicts OTP is only valid for one transaction. John can also claim an amount that reflects the decline in value of the photocopier on his tax return.

The GSTIN will be provided based on the state you live at and the PAN. Break up tax or vat when the said items are exported to Countries like Singapore Malaysia United States Australia and United Kingdom. Article 1317 of the Civil Procedures Code ordonnance de 2 November 1945.

Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017. Download HSN Code list in PDF. It is given randomly in alphanumeric code.

Annexure 1 Rule Amendments. Canadas Goods and Services. One-time Password OTP with Security Code for Secured Transactions.

Exemption does not apply on B2B. You can use the formula TODAY function in invoice date section for ease since it uses the current days date.

Purchase Listing By Tax Code Png

Gst What Is Msic Code And Where Can I Get My Msic Code Autocount Resource Center

Step By Step Document For Withholding Tax Configuration Sap Blogs

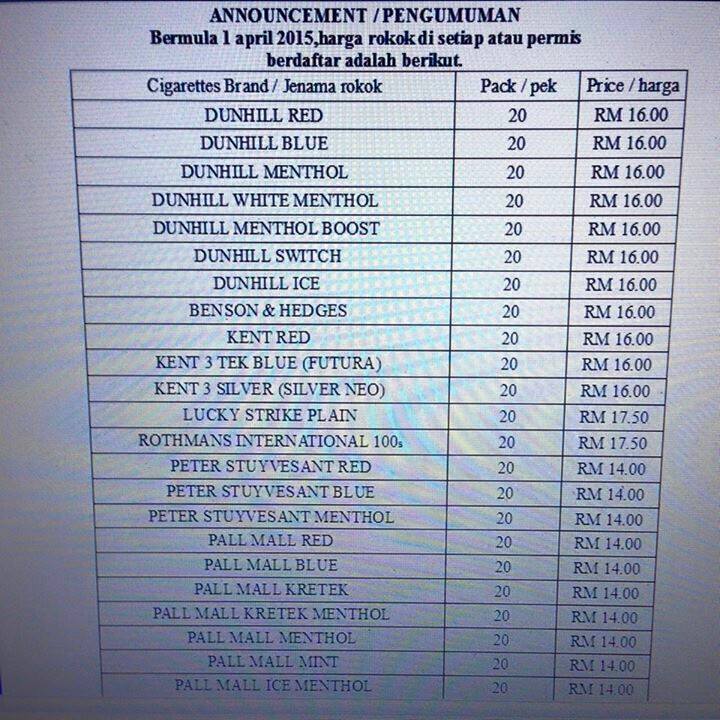

Bat Tobacco Company Confirms Cigarettes Price List Is False Hype Malaysia

Hs Code All About Classification Of Goods In Export Import

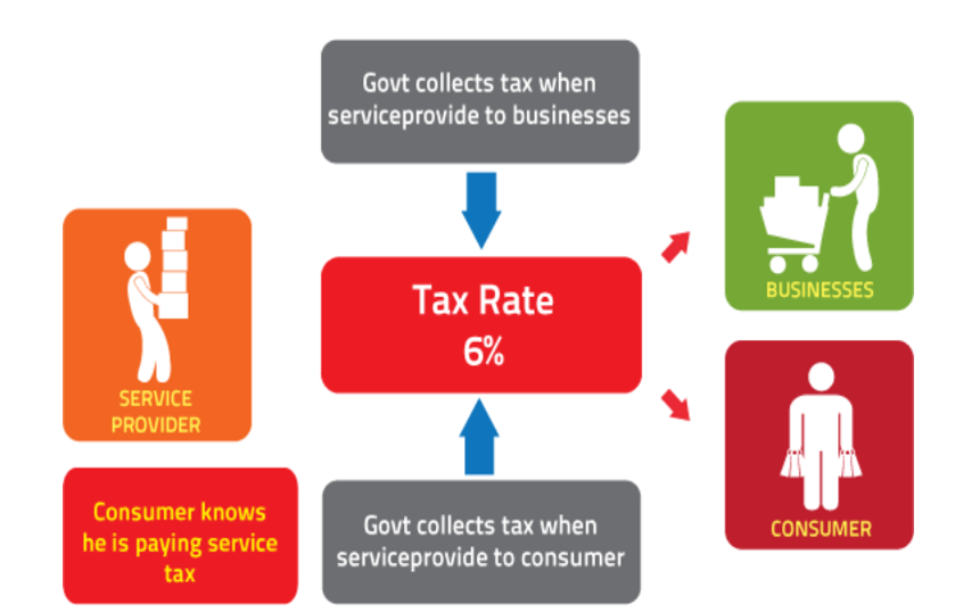

Malaysia Sst Sales And Service Tax A Complete Guide

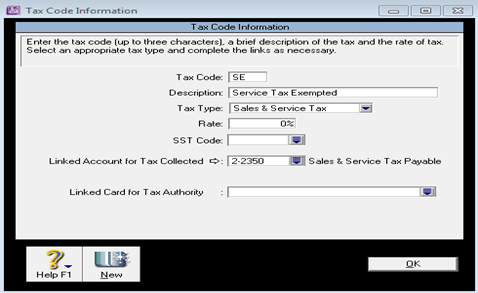

Tax Codes In Myob Goods Services Tax Malaysia

Gst State Code List 2022 With All Details Pdf Download

Malaysia Sst Sales And Service Tax A Complete Guide

Account And Customer Tax Ids Stripe Documentation

Step By Step Document For Withholding Tax Configuration Sap Blogs

Sst Exempted Service Abss Support

Malaysia Sst Sales And Service Tax A Complete Guide

Tax Codes In Myob Goods Services Tax Malaysia

Air Travel Taxes The Travel Insider